Sovryn AMA Recap: Building a More Inclusive and Accessible Ecosystem on Bitcoin

The Sovryn launch event on February 9th marked the start of a new chapter for the DeFi protocol. Sovryn unveiled its dedication to Bitcoin-backed stablecoins, 0% interest loans, and making decentralized swaps accessible to everyone.

Sovryn Co-founder, Edan Yago (EY) and Rootstock/Sovryn ambassador, Alexandria (A) came together for a Twitter Space on February 24th to discuss the new Sovryn and answer questions from the community.

Listen to the full recording on Twitter here or read some of the key highlights from the conversation below.

🚨Now live with @SovrynBTC 🚨

Join @EdanYago to discuss Sovryn Wallet, building on Rootstock, Ordinals, and more👇 https://t.co/YjO7FkmWLf

— Rootstock (@rootstock_io) February 24, 2023

Let’s start with a quick introduction. Yago, tell us a little bit about yourself.

EY: I was born in South Africa during the apartheid era to a family of politically active people. And because my family was politically active, and associated with the ANC, some of them started to be considered terrorists by the apartheid regime, and they had to flee South Africa. My first engagement with this sort of activism was when I was a young boy, between the ages of 9 and 11, I had to help smuggle gold out of South Africa to get money for my family.

After leaving South Africa, I pursued philosophy and later neuroscience and machine learning. I ended up at Carnegie Mellon University in the US, where I started a business focused on developing machine learning tools for improving diagnostics. In 2011, I stumbled upon the Bitcoin whitepaper, which changed my trajectory. My focus shifted to Bitcoin as a means of promoting individual freedom, creating a better financial system, and increasing global access to finance

And that is what led you to Sovryn?

EY: Yes, I discovered Sovryn through my connections in the Bitcoin community, who were developing decentralized tools to enhance Bitcoin’s decentralization. One of the big problems with Bitcoin is that it is secured by proof of work and by cryptography, but anything you want to do with Bitcoin requires you to give up self-sovereignty and use a centralized service, which either fail or are so successful they tempt people away from true ownership.

When I learned about Sovryn and their efforts to decentralize various Bitcoin-related activities, I got more excited than I’d been since my first encounter with Bitcoin. Sovryn really has been a phenomenal home for me, and for many members of the community. It has become the single largest ecosystem in the Bitcoin DeFi space, surpassing Liquid or Stacks, with more users, and more organic activity. I think it’s only at the beginning.

Alexandria, can you introduce yourself?

A: I am a Rootstock ambassador and content creator. I was interested in Sovryn because it offers numerous solutions to South Africans. So I write for those who are keen and insistent about learning about stablecoins, how they can earn on top of Bitcoin, and how they can borrow and lend at a 0% interest rate.

What are the values that drive Sovryn?

EY: Sovryn is a project which is built around several key fundamental ideas. One is that we believe in the individual. We want to create a world where even minorities have rights, and are empowered. Every single thing that happens, every new idea, every new invention, every act of kindness, and every act of cruelty, is performed by individuals and impacts individuals.

The other big thing is creating a community. Human beings are able to best empower themselves by collaborating with other people, and one of the problems with projects that are very focused on the individual, or ideologies that they lose the ability to think about how we can collaborate. So the first thing we did at Sovryn was building tools for collaboration, specifically, the DAO, and creating consensus.

We believe that technology is the way to get there, and we believe that the way that we do that is by not losing ourselves in technology, but rather, using technology to improve the real physical world that we live in. We need to build tools that are so simple that they can be accessible to anyone in the world.

Edan Yago speaking at the Rootstock Summit in Buenos Aires, November 2022

When did the idea for Sovryn start?

EY: We were concerned by the fact that Bitcoin is only half complete if you have to trust others in order to be able to use it. But the technology to build decentralized platforms for Bitcoin wasn’t available, and I think one of the big things that changed that was Rootstock. Rootstock provides a layer secured by Bitcoin’s proof of work with smart contracts functionalities, which allowed us to start building out the type of tools for Bitcoin that can create an entire economy.

What we’re seeing with Sovryn is the emergence of a radically rethought economy, which doesn’t depend on laws, courts, and politicians, but instead depends on Bitcoin and Bitcoin consensus. As a result, not only Bitcoin provides true ownership now, but other tokens provide true ownership, and we can build other things with true ownership, like communication or governance systems.

How does Sovryn help the unbanked access loans and the typical financial instruments found in regular banks?

EY: Sovryn provides different things that people have built for/with Sovryn — trading, margin trading, different types of borrowing and lending, savings accounts, stablecoins, ways of and there is also work on NFT markets. I think the core difference is that in all of these things, you remain the owner. You don’t hand your funds over to another person and you don’t require their permission in order to use the system. So the only thing that you interact with is a set of rules, and the system automatically follows those rules. There are no trusted intermediaries, and the rules are all transparent, written in code, supported, and enforced by Bitcoin’s proof of work.

The new look Sovryn platform was recently revealed. What are some of the new platform functionalities that come with this refresh?

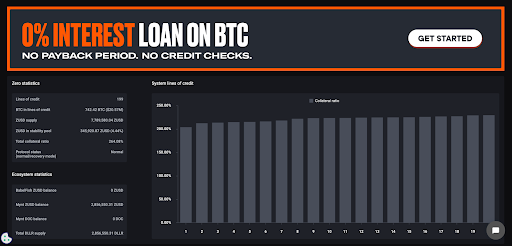

EY: [We unveiled] a protocol called zero, which allows you to borrow against your Bitcoin at a 0% interest rate. This protocol is in early release, but soon there’s going to be a new interface, and everyone will gain access to it. You can also switch between Bitcoin and other assets, and there’s going to be the introduction of the Sovryn dollar — an aggregated Bitcoin-backed dollar that uses the best methods for creating stability.

The Sovryn protocol also generates revenue, it takes a fee for interacting with it in different ways. Those fees are paid to people who stake the SOV token and participate in securing the protocol. It’s a new way of thinking about staking, it’s self-sustaining, and it’s an organic, real economic activity that is driving the revenue of the protocol.

Source: sovryn.app

How does Rootstock compare to other Bitcoin layer two solutions? And how much of that is on Sovryn?

EY: I think that unquestionably Rootstock is the truest and most performant example of a Bitcoin layer two system. Let’s talk about different Bitcoin layer 2 systems that are out there. There is the Lightning Network, Stacks, Liquid, and there are many others as well. What differentiates Rootstock is that it has a number of attributes, which don’t exist [in] any of these other systems. It has three important attributes.

- It is secured through merge mining with Bitcoin,

- It uses Bitcoin as the native asset, and

- It is Turing complete.

These [attributes] aren’t true for Stacks, Liquid, or Lightning.

And there’s a fourth attribute, which is scalability. Right now, Rootstock has limited scalability, but we already see the path with effectively infinite scalability with Rootstock technology, via rollups, and that’s something that even Lightning Network cannot say.

Can you tell us a little bit about the inner workings of the Sovryn dollar? And how it compares to other stablecoins in the space such as Money on Chains DoC.

EY: Money on Chain’s DoC is a component of the Sovryn dollar. You can deposit DoC into the Sovryn mint protocol and get a Sovryn dollar. The reason for this is that there isn’t just one way of creating stability, there are many ways of creating stability. In fact, the more diversified the system is in terms of methodologies, the more stability you get. If we have 100 different Bitcoin backed dollars, none of them go anywhere. But if we concentrate our efforts, we all work together to create one deeply liquid standardized dollar, then it is much more likely to succeed. Imagine that every time you went to the store they had to tell you “oh, we don’t accept dollars from Citibank, we only accept dollars from Chase Bank”. The dollar would be almost useless. So we need to find a way of making all of these Bitcoin backed stable coins interoperable, and that is what [the] Sovryn mint does by taking them, aggregating them and creating a standardized Sovryn dollar. The Sovryn dollar is the reason the project is called Sovryn. It’s an independent self-governing dollar.

Is there a difference between ZUSD and the DLLR or do they refer to the same token?

EY: ZUSD is like DoC, it is one way of creating stability. The Sovryn dollar’s ticker is DLLR.

What can we expect coming from Sovryn in the near future?

EY: Right now, the focus is on getting the Sovryn dollar out, and growing the use cases around it so we can grow the viability of a Bitcoin-backed stablecoin, and grow projects like zero and Money on Chain and others.

This is becoming increasingly important as USDC, Tether and DAI become less and less reliable and more and more regulated.

Beyond that Sovryn is working on introducing better UI so that you don’t need to be technical to use the platform, greater scalability for the platform, and building out an ecosystem to take advantage of that scalability.

Will there be a Sovryn Wallet?

EY: Sovryn doesn’t have an official Sovryn wallet. However, there is a project called Sovryn financial who are building a wallet. They are just one of many projects who have wallets that interact with Defiant wallet, Metamask, Liquality, and many others. But what’s interesting about Sovryn Financial as a project, is that it is a decentralized company separate from the Sovryn protocol started by people from within the community. It’s trying to build a wallet that is specifically focused on providing an easily accessible way to use the tools of Sovryn rather than trying to be a general-purpose wallet. That kind of specificity can create a much more powerful user experience.

Sovryn Financial: The premise for Sovryn Financial is to leverage all the benefits of the complexity of Rootstock. The cool thing about what we’re trying to build is we’re trying to abstract away side chains and smart contracts, so that the average Bitcoin owner who just wants a loan, who doesn’t really care to learn about DeFi and Smart Contracts and protocols and side chains, they can still reap the benefits of it through this app. You can start with Bitcoin and get a loan in dollars, start with Lightning Bitcoin and be able to earn interest off of it, and still reap the benefits while Rootstock does all the work in the background.

Is there anything else you would like to share before we finish?

EY: If anyone hasn’t tried using some parts of some protocol yet, I recommend you try. There’s a lot of opportunity for participating in the community if you want to help the project by becoming a sponsor, developing new things, contributing to technical problems, or just helping spread the word, feel free to reach out.

To stay up to date with the latest developments on RIF and Rootstock, follow RIF and Rootstock on Twitter and sign up for the Rootstock Newsletter.

This was an edited transcript of a Twitter Space between Edan Yago, Alexandria, and Rootstock Contributors. Follow Sovryn on Twitter to keep up with the latest news.