With RBTC powering DeFi for Bitcoin, why wrap your BTC?

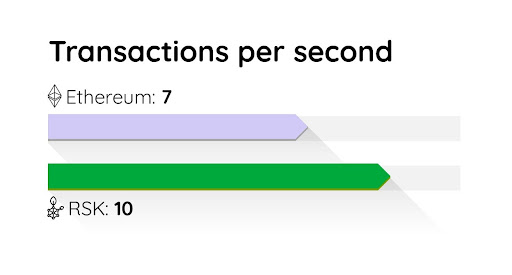

Transactions on RSK vs. Ethereum

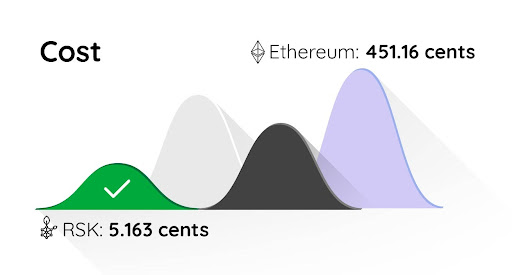

Note: Data collected 7th February.

Gas fees are constantly changing. View the latest data.

Until a few years ago, when you heard DeFi you probably subliminally thought of DeFi on Ethereum. Now, with over 13 DeFi protocols built on or integrated with RSK, and 18 wallets, DeFi for Bitcoin is a reality.

For those who are new to the concept, DeFi describes financial services that are built on a blockchain such as Ethereum or Bitcoin. Essentially, it enables users to trade, earn interest or borrow against their crypto assets through the use of Decentralized Applications (DApps).

Keep reading to learn about some of the key reasons the Bitcoin DeFi ecosystem on RSK has taken off, and what makes RBTC the better option against wrapped Bitcoin alternatives that are currently used on Ethereum.

Wait, what is wrapped Bitcoin?

Launched in 2019, wrapped Bitcoin, (WBTC) is an ERC-20 token that represents Bitcoin (BTC) on the Ethereum blockchain. WBTC was created as a way to use Bitcoin on Ethereum wallets, dapps, and smart contracts.

Through a WBTC partner, 1 Bitcoin can be converted to 1 Wrapped Bitcoin, and vice-versa. The BTC that backs WBTC is verified through a proof of reserve system that confirms the 1:1 backing between minted WBTC tokens and Bitcoin stored by custodians.

And how is RBTC different from WBTC?

RBTC is the native token of RSK, a layer-two sidechain to Bitcoin. It adds smart functionality to Bitcoin, like the ability to build smart contracts on the network. When you transact with RBTC, you remain in the Bitcoin ecosystem.

Because RBTC is an RSK ecosystem token, it doesn’t conform to ERC 20 standards, meaning without crossing it to Ethereum using the token bridge, it cannot be used on Ethereum based DeFi protocols.

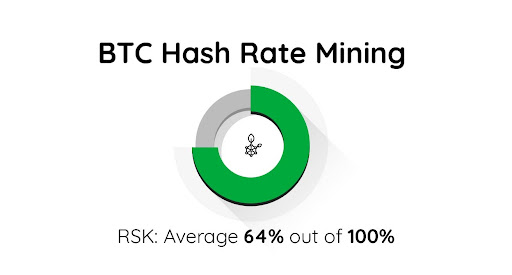

Like WBTC, the value of RBTC is pegged 1:1 with BTC, although through a different mechanism. RSK uses a 2-way peg called Powpeg, the first Bitcoin peg to provide security assurances based on Bitcoin’s proof-of-work, making it the most secure and permissionless peg available today.

Why should I use RBTC instead of WBTC?

WBTC has come under scrutiny for seemingly going against the core principles of the Bitcoin network – decentralization, privacy, and autonomy.

- Security

To unlock RBTC, the RSK network utilizes a process called Powpeg swaps. Powpeg initiates a proof-of-work secured two-way peg interaction between the RSK sidechain and the main Bitcoin blockchain.

The Powpeg protocol involves a secure, permissionless, and trustless transfer of a cryptocurrency from the main blockchain to the secondary blockchain (RSK) and vice versa.

The PowPeg system on RSK is supported by 11 independent bodies. Their role is mainly to keep their hardware and nodes connected and alive at all times. Of all 11 bodies, no single entity, or group, has the power to unilaterally perform peg-out operations, or selectively censor peg-outs.

Whereas wBTC is managed by a federation composed of 3 publicly disclosed members (BitGo, Kyber Network, and Republic Protocol), of which any 2 of them can make changes to the smart contracts or move funds.

Note: Get the latest stats on the RSK Explorer.

- Non-Custodial:

Remember the golden rule; “not your keys, not your coins”. In the WBTC protocol, the DAO members hold keys to the main multi-sig contract which can alter and make changes to the smart contracts at will.

In the case of RBTC, the receiving address is determined by the public key of the sender, such that both accounts are controlled by the same private key. This means that you retain the keys to your Bitcoin, every step of the way, without the interference of any third party.

- Cost:

To interact with WBTC you will need to pay transactions fees each time you wrap and unwrap wBTC as well as when you make withdrawals. Gas fees on Ethereum are significantly higher than on Ethereum, having hit 200x more expensive on Ethereum recently for certain transactions.

What DeFi options are there on RSK?

It’s no longer the case that dApps (Decentralized Applications) can only be built on the Ethereum network. With RSK’s added functionalities, Bitcoin has proven to be not only the most secure blockchain to build DeFi apps on but the most efficient as well.

Here are some exciting dApps that have been built in the Bitcoin-based RSK ecosystem, and make sure you visit the website to learn more about all of the projects that are live.

- Money on Chain – Stablecoin & Leverage

Almost every blockchain has a stablecoin. For people who wish to have their funds stored on chain as a non-volatile store of value or as a means of efficient payments for goods and services, a stablecoin is the perfect means to achieve this. Money on Chain meets this need by providing a 1:1 USD pegged stablecoin that is backed by Bitcoin.

Money on Chain offers a Bitcoin Collateralized Protocol full suite of DeFi services which includes a stablecoin, a HODL token, as well as a leveraging mechanism – all backed by Bitcoin.

In addition to solving the Bitcoin volatility challenge, it also enables users to improve the performance of their crypto assets, while retaining full control of their private keys. Over the past year, BPro holders have enjoyed 25% returns, that’s on top of BTC’s performance!

Sovryn – DeFi – Trade, Borrow & Stake

Sovryn is a non-custodial and permissionless smart contract-based system that leverages the Bitcoin ecosystem to provide a wide range of DeFi services including lending, borrowing, yield farming, and margin trading. And by using RBTC, Sovryn users can access these services without the need for KYC, or third-party custodial protocols.

Tropykus – Savings & Loans

Tropkus puts the finance into DeFi. This unique platform offers digital savings and loans services with an emphasis on Latin America, and without the excessive paperwork, KYC, or hidden fees common in CeFi.

The Tropykus protocol offers accessible credit products on the Bitcoin-based RSK network. The financing opportunities are made accessible to all users no matter their financial status or credit history. Furthermore, repayments are 100% flexible and users also get to withdraw from their savings at any time without having to pay huge fees.

This RBTC-powered platform essentially helps to protect your savings against the deteriorating effects of inflation and local currency devaluation.

Wallets

Wallets are the final jigsaw in any DeFi puzzle. Primarily, DeFi Wallets are essential for providing a secure mechanism to keep your funds. However, it is also crucial for them to be accessible and have intuitive interfaces for interacting with diverse DeFi products.

Here are some amazing DeFi wallets that are available on the RSK network.

Liquality is a universal wallet for buying and swapping crypto assets. Liquality supports swapping crypto assets from RSK to other chains like Ethereum and BSC as a multi-chain wallet.

With Defiant, you can access several blockchains – RSK, BSC, Ethereum – all in one wallet. You can also buy and store NFTs with it.

Trusted by over 21 million users, Metamask is a wallet and a gateway to Blockchain apps.

#1 Crypto Wallets for Institutions. Hundreds of businesses use Fireblocks to manage treasury operation, manage their digital assets, and access DeFi.

RSK has enabled the development of many unique DeFi solutions that use RBTC to execute transactions on the network.

But DeFi on Bitcoin isn’t siloed in one ecosystem- you can also manage your DeFi assets in one place with unified wallet and custody solutions like Liquality and Fireblocks. Pick and choose the DeFi protocols that best suit your needs, whether that’s on Ethereum or Bitcoin.

wBTC was built primarily for using Bitcoin to access the world of decentralized finance, but RSK has proven DeFi and DApps are not restricted to the Ethereum network alone.

Now it’s time to stop overpaying for transaction fees, setlling for inferior security, and loosing sight of the original spirit of cryptocurrency and decentralization.